Many US banks have posted higher-than-expected noninterest expense growth in their 4Q21 earnings due to inflationary pressures from wages. For example, Goldman Sachs Group Inc. shelled out an additional $4.4... read more →

As we get ready to welcome 2022, are there any key risk factors which emerged this year and are expected to influence the economy next year? Inflation and its implication... read more →

In a recent LinkedIn post we highlighted the risk of repricing for real estate assets due to rising interest rates and inflation. The latter will also negatively impact industries that... read more →

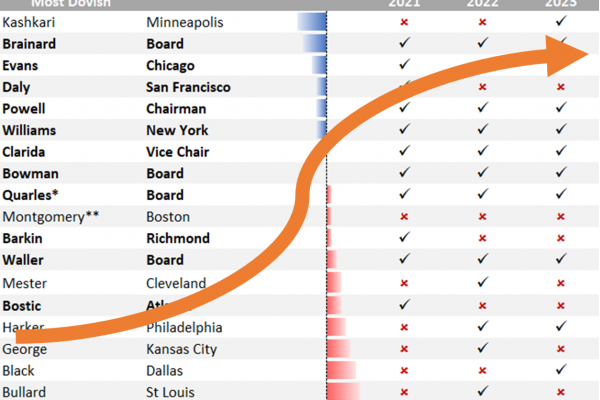

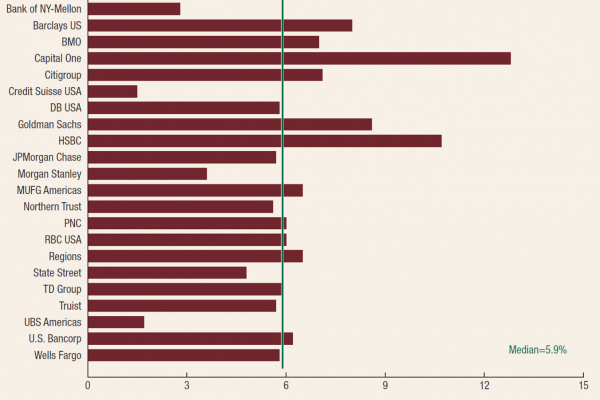

On June 24 the Federal Reserve released the results of its annual bank stress test: https://www.federalreserve.gov/newsevents/pressreleases/bcreg20210624a.htm The results have showed that all 23 banks that participated in this year’s exercise... read more →

One of the criticisms of regulatory stress testing is the assumption of constant balance sheets for banks during the horizon of a stress scenario. In this article we examine some... read more →

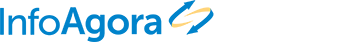

On February 12, the Federal Reserve Board released the hypothetical scenarios for CCAR 2021: https://www.federalreserve.gov/newsevents/pressreleases/bcreg20210212a.htm Although the scenarios are intended for testing the resiliency of large banks, the top 19... read more →

The Federal Reserve Board just released the scenarios for the second round of stress testing for the large banks. https://www.federalreserve.gov/newsevents/pressreleases/bcreg20200917a.htm The second round scenarios include two hypothetical scenarios with a... read more →

In a recent post we introduced our RMA journal article on the “Forbearance Cliff”, a cliff that banks and borrowers have been faced with as the corresponding accommodation programs expire.... read more →

Forbearance is a “wait-and-see” strategy for banks to reduce uncertainties associated with the recovery and flatten the loss curve. However, it cannot last forever. As the so called accommodation programs... read more →

As the Paycheck Protection Program Flexibility Act has just been signed and the loan forgiveness process of the program is about to start, the ADP national employment report for May... read more →