One of the trends identified in our two articles of the Canadian Bank’s FY2019 provisions (Part I and Part II) was the y/y increase in Stage 2 migrations, far more... read more →

In our previous analysis of the Canadian Banks’ FY2019 provisions we posed the question whether the significant y/y increase in provisions is an one-time adjustment or the start of a... read more →

The Big Six Canadian Banks reported their year-end results last week. Half of them missed expectations following a similar pattern in 2019 Q3. The news in this earnings release though... read more →

With only few months until the CECL implementation deadline of January 1 2020 for SEC filing banks, the latter should be currently undertaking parallel runs, performing model validation, and updating... read more →

In a poll we recently conducted at a community bankers’ forum, selection of the forecasting method ranked by far as the top challenge for CECL implementation. Scenario selection was ranked... read more →

At today's board meeting FASB voted to: Simplify the bucketing of effective dates for CECL implementation to two: (i) SEC filers excluding smaller reporting companies (SRC) as currently defined by the... read more →

The Board of Governors of the Federal Reserve System (FRB), the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA), and the Office of the Comptroller of the... read more →

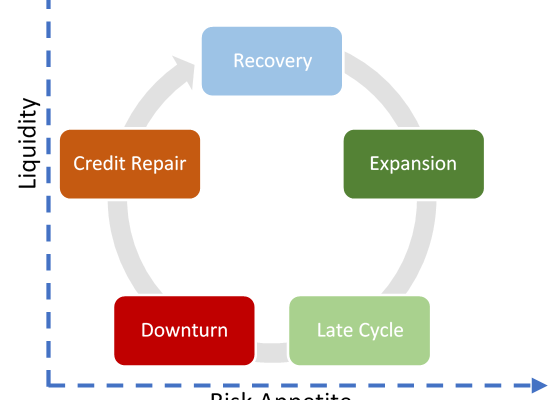

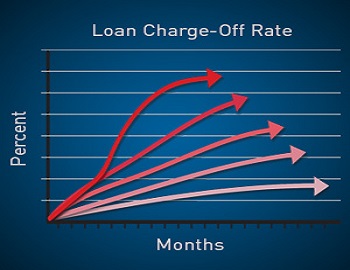

Macroeconomic forecasts are one of the key drivers of CECL reserves due to the non-linear effects of macro factors on losses. Yet, practitioners tend to focus on the loss quantification... read more →

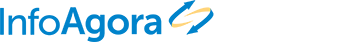

Nonfinancial corporate debt to GDP has reached its highest post-war level as per first chart below. Although corporate leverage is expected to rise in expansionary years, its elevated level tends... read more →

Insights for CECL in advance of 3rd CECL Conference, Oct 24-25 in NYC. Don't forget to stop by at our booth to chat how we can help you with your CECL implementation... read more →