The Q2 data releases for GDP and Consumer Spending (personal consumer expenditures) within the last couple of days validated two of our recent predictions regarding Residential Investment and Consumer Spending.... read more →

Several large U.S. banks have been reporting 1Q2022 earnings in the last two weeks. What are some of the key themes from these reports, and what could they imply for... read more →

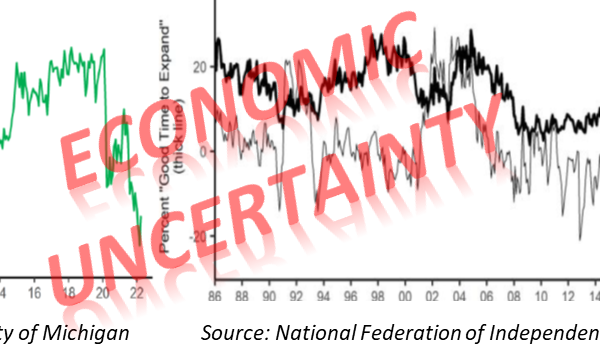

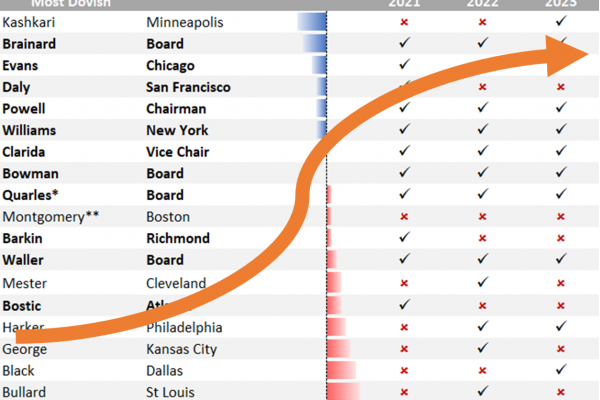

As we get ready to welcome 2022, are there any key risk factors which emerged this year and are expected to influence the economy next year? Inflation and its implication... read more →

In a recent LinkedIn post we highlighted the risk of repricing for real estate assets due to rising interest rates and inflation. The latter will also negatively impact industries that... read more →

The largest US banks reported very positive second quarter earnings last week despite generally lower net interest margin and negative loan growth. The positive earnings were mainly due to a... read more →

The CARES Act allowed SEC filing banks (Not Smaller Reporting Companies) to temporarily postpone the effective date, January 1 2020, of the current expected credit loss (CECL) standard. A small... read more →

In a recent post we introduced our RMA journal article on the “Forbearance Cliff”, a cliff that banks and borrowers have been faced with as the corresponding accommodation programs expire.... read more →

Forbearance is a “wait-and-see” strategy for banks to reduce uncertainties associated with the recovery and flatten the loss curve. However, it cannot last forever. As the so called accommodation programs... read more →

Why do some of the choices of CECL design components introduce significant inaccuracy and procyclicality in banks’ provisions? How can scenario selection in particular result in inaccuracy in ECL with... read more →

Over the last few weeks we published a series of three articles analyzing the IFRS9 allowances and provisions of the Big Six Canadian banks based on their disclosures for Expected... read more →