The Q2 data releases for GDP and Consumer Spending (personal consumer expenditures) within the last couple of days validated two of our recent predictions regarding Residential Investment and Consumer Spending. The predictions were posted on July 21 and July 27 respectively.

We focus on these two macroeconomic factors because they are part of the set of significant predictors in credit risk forecasting particularly for loans related to consumer.

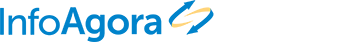

More specifically, in our July 21 article we said: “real residential investment correlates well with the y/y change in the 30yr fixed rate mortgage when lagged by two quarters (inverted on the right axis). Thus, given the significant y/y rise in mortgage rates in the last two quarters, we expect real residential investment to exhibit negative growth in the coming quarters, between -5% and -15%.”

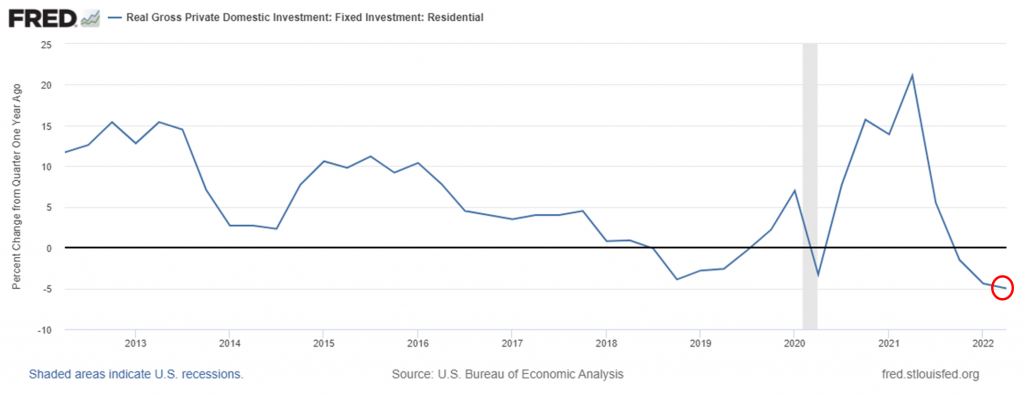

Indeed, Real Residential Investment dropped by 5% y/y as shown in Figure 1 below. It was also the second most negative contributor to GDP growth (see Figure 2), with inventories being the top most negative contributor. We expect the downturn in Real Residential Investment to continue at a much higher pace in the next quarter given its two-quarter lag with mortgage rates.

In our July 27 article we reviewed recent trends in US Consumer that indicated a structural shift and weaknesses in spending. We posed the question whether the weaknesses in consumer spending will be reflected in Q2 GDP.

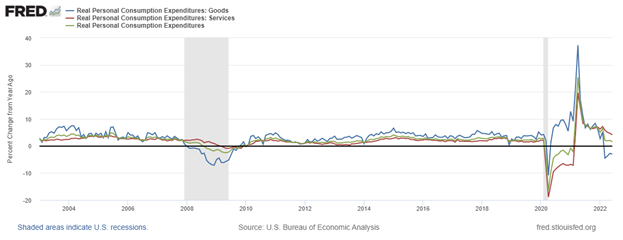

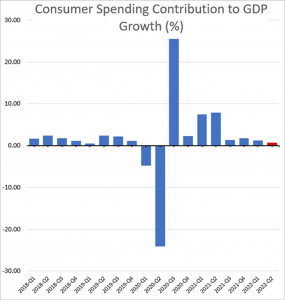

Indeed, Figure 3 shows that the contribution of Consumer Spending to GDP growth was dismal in Q2. Furthermore, Figure 4 depicts the Real Personal Consumer Expenditures (Real PCE) and its breakdown into Goods and Services. The growth of the expenditures in Goods has turned negative since March whereas the growth in Services has remained positive albeit at a slower pace.

Figure 1.

Figure 2.

Figure 3.

Figure 4.